HEY DAD

YES, THIS IS ABOUT AXE-FORTUNE

After much deliberation I’ve decided to go ahead and be an annoying son.

AXE-FORTUNE appears to be a brokerage site offering a personalized service and excellent returns.

However, there are a few points of concern that lead me to believe that they do not deserve your money, or your trust.

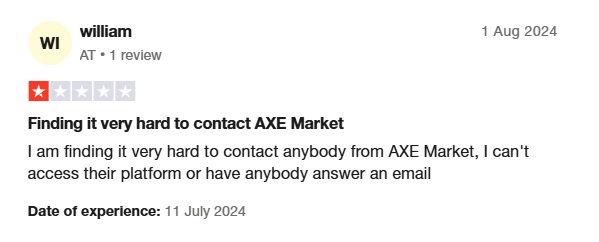

“I am finding it very hard to contact anybody from AXE Market, I can’t access their platform or have anybody answer an email.”

— William

The online optics are nOT good

I’m all for forging your own opinions. But sometimes it helps to see what others are saying.

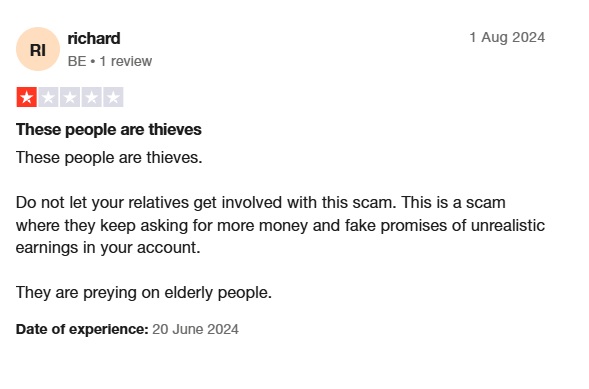

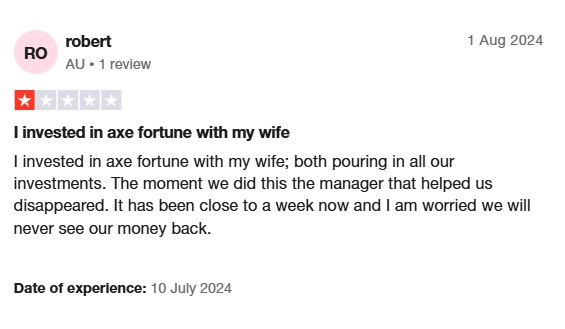

There is very little about AXE-FORTUNE to begin with, not to mention their site is rather difficult to find on a web search. What wasn’t hard to find however, were the Trustpilot reviews.

A lot of unhappy customers considering the number of reviews, and those 5 star reviews are seemingly very generalized and unspecific. A common trend among botted reviews.

Still, Some bad reviews don’t mean a product or service are inherently bad, or dishonest. Especially when its just a handful of unverified accounts.

FINCAPITAL-REVIEWS is a little different to your user review sites. They are a rather reputable site who specialize in finance.

“We provide comprehensive reviews of a wide range of platforms so that you not only have an excellent selection but also stay cautious and avoid unreliable companies.” – FINCAPTIAL-REVIEWS

They are also the only other sources of anything involving AXE-FORTUNE with legitimacy. Here, have a read of their experience. Click here

NO EXPERIENCE

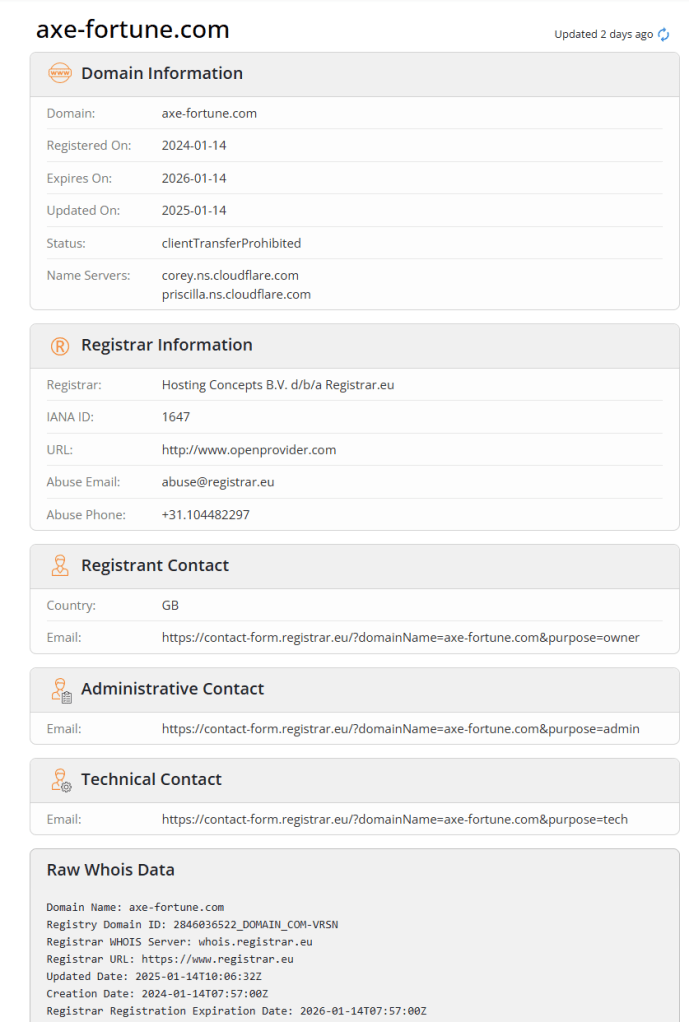

As the Fincapital review pointed out, Axe fortunes domain was only registered in 2024-01-14.

That’s not a long time to be giving financial advice. Especially when that advice comes without any confirmation on the physical address or country in which the firm is registered. As well as no information on founders or management teams.

YOU CAN’T LEVERAGE THAT HERE

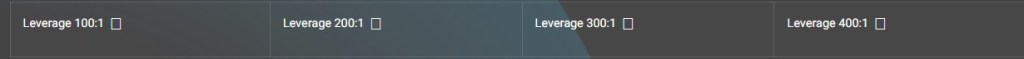

Currently in Australia the legal leveraging limit for brokers is 30-1.

Axe is offering a base of 100-1 all the way up to 400-1. A rather insane rate of risk and an illegal offer within the boarders of Australia…

NO ACCOUNTABILITY

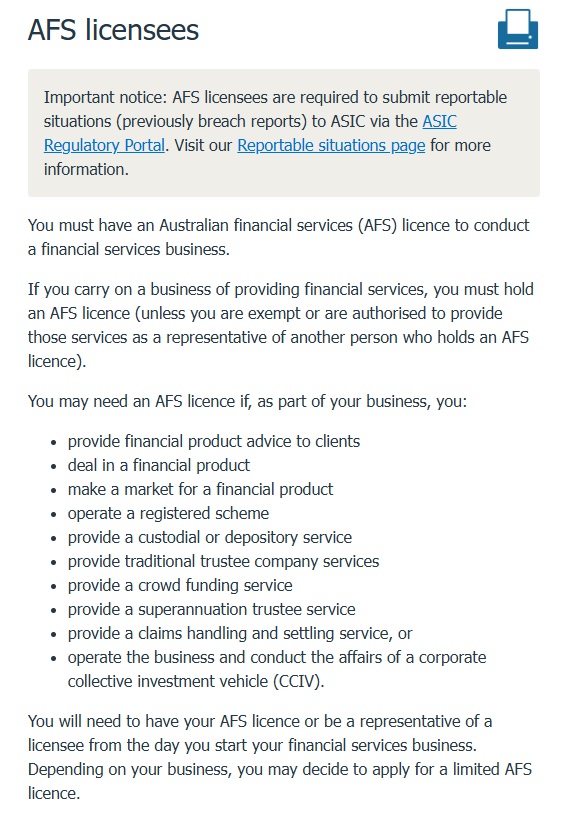

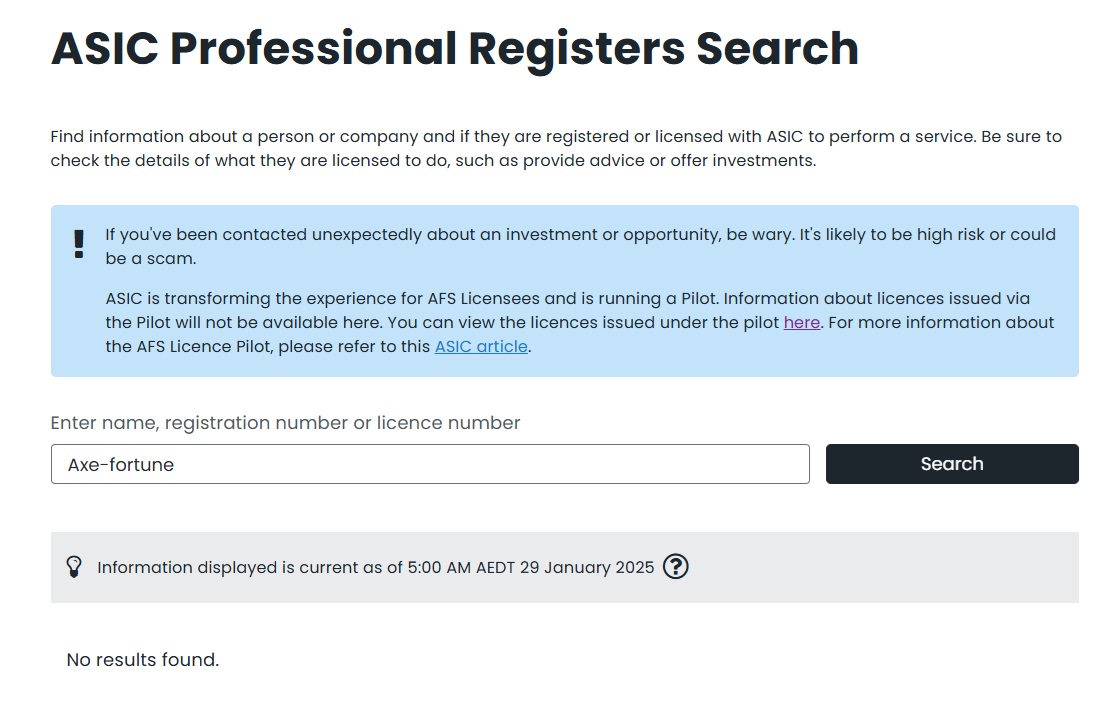

A big reason they seem comfortable to offer such insane leveraging options is because they are selling a gamble rather than any tangible assets. Similar to the practices of a Hedge fund. However it is important to note that any company wanting to be considered legitimate , especially with an Australian clientele, should have an AFS (Australian finical servicers) license.

Unfortunately AXE-FORTUNE does not come up in the AFS registry, meaning they most likely do not hold an AFS.

Put simply:

Platforms without proper licensing often engage in scams or fraudulent activities, making it hard to recover funds if something goes wrong.

Limited Legal Recourse:

If the company is unregulated, it may be nearly impossible to hold them accountable or recover lost funds through official channels.

Further more it means unlike trusting STAKE or VANGUARD with your personal information, you are extremely susceptible to identity fraud as AXE-FORTUNE holds no real accountability for your information.

SPEAKING OF LEGALLY

Although it is common for investment platforms to requests information such as ID, Credit Card and even utilities bills; it does so only to set up your account, not to bar you from your money. Most importantly they hold an AFS and are legally accountable for that information.

With regards to AXE-FORTUNES legal document it stipulates:

“To be eligible to make a withdrawal, you must first supply full compliance documentation (Passport copy, valid utility bill, and, in some cases, a copy of the credit card used to make the deposits). The minimum withdrawal amount is $50 by credit card or its equivalent in your chosen fiat currency. There is no fee for withdrawal by credit card.”

As well as:

“In any case of full account closure Axe Fortune reserve the right to deduct a processing and service fee of up to 25% of the remaining balance before processing the withdrawal of the remaining balance and proceeding with full account closure.”

Both clauses are a common tactic to use in order to hold and discourage people from moving their own money or closing their accounts. Its difficult to pull your money out and the “Up to 25%” is especially vague and does not clarify when or why maximum fees may apply.

With no AFS or admitted address this aids AXE-FORTUNE even further to hold no accountability for your funds if lost.

WHAT COMES NEXT

After all is said and done your money is your money. There is also every possibility that though what AXE-FORTUNE offers isn’t strictly above board, it is ultimately something you are willing to gamble for. But just be certain you understand it is a gamble, not just with the stock exchange but also whether or not you can even draw your winnings.

I just ask that you please take precautions to protect yourself. Read this, at a minimum to help keep yourself vigilante as well as speak to your bank about your investments so they are aware and can offer a 3rd party voice.

If however any of this has made you feel uneasy about AXE-FORTUNE. Going forward simply refrain from giving any more money over to them, change your passwords on your main everyday accounts, notify the bank of your uncertainty so you can speak with the fraud team and they can direct you from there.

Love your overly cautious son.